Did the Internet kill strategy?

Strategy is dead

The field of strategy initially came in for some fierce criticism during the early days of the commercialization of the internet. "New era" theorists claimed that this time was different, that strategy as planning could not keep up with "internet time," that strategy as practiced in corporate settings in the mid-1990s - was at best inapplicable to the internet context and at worst, well, dead.

When the market is going to change in six months to a year, you can't spend two months worrying about a strategy. So you have to compress the time.

Rick Schell, Netscape Director of Engineering, cited in Yoffie, David B., and Michael A. Cusumano. 1999. “Building a Company on Internet Time: Lessons from Netscape.” California Management Review 41 (3): 8–28.

Such rhetorical flourishes did not age well. As it turned out, those arguing for the death of strategy were often "drinking their own Kool Aid," hoping that strategy did not matter because if it did, their firms were the ones who were destined to struggle. In many internet-derived, emerging market segments, strategy was paramount, and winners and losers were sorted not by purity of a firm's commitment to new and magical internet thinking, but by its ability to assemble defensible bundles of resources and deploy those resources effectively in competition with other firms pursuing different strategies.

How was the wireless web built?

Find out more

AuroraTec's search for competitive advantage

AuroraTec was principally a service provider to companies seeking to bring web-based content to the wireless customer. For AuroraTec, the challenge was to develop a hybrid product-service offering that created competitive advantage for the firm and also enabled it to streamline the process of getting a client to sign on to having its PC-based web content semi-automatically transformed and served through the AuroraTec system.

Selling “automatic translation” to content companies

The search for a "productized" solution - something AuroraTec could own, market and sell - put the firm on a collision course with the evolving realities of internet strategy.

AuroraTec

- AuroraTec Overview

- Enabling infrastructure for the wireless web

- All devices (mobile phones, PDA’s, pagers, other) and mark-up languages (HDML, WML, cHTML, MML, tHTML, VoXML, other)

- Dynamic (transaction based) as well as static content

- Frames, Javascript, cookies

- Easily extensible to new devices, MLs

- Internet, Intranet & Extrannet

- Patent pending technology

Challenges arose from both the content suppliers and the wireless providers. AuroraTec hoped that their "rendering tool" - a software package that would semi-automatically transform web-based content into a streamlined, wireless version of itself – would offer such a hybrid product-service solution.

AuroraTec

- What makes us unique

- Proprietary technology leverages full functionality of web site

- Dynamic vs. static content

- No changes to web site/device are required

- No tags, additional servers, client software

- No persistent data stored in content servers

- Single architecture across multiple devices

- Very rapid deployment – days not months

- Web site can change substantially without affecting “mobilized” content – XML fingerprinting

- Data and voice

- Future proof – new devices and web site changes based on XML architecture

For AuroraTec, automated rendering of web-based content was a critical capability and something that the firm wanted to claim as a source of strategic advantage. But as is often the case with experimental technology, the capabilities of the tool were limited. Internal communications described “automatic translation” as a “catch all mechanism for rendering” and as a “cheap solution.”

As a practical matter, it did not always work. For instance, not all web content could be automatically translated: notwithstanding the company’s hopeful statements to content partners, the technical team in AuroraTec recognized that they would need to dictate certain changes to partner websites for the tool to successfully complete “automatic translation.” If the customer’s website met certain requirements, the tool could work, but many sites were non-conforming.

AuroraTec

Automatic translation is the catch-all mechanism we need to add so that we can handle component identification failures. Many customers are willing to change their websites in order to have more reliable component identification. For them, we need to be able to prescribe the changes they can make in their website to bypass our component identification. Then their application changes only for rendering needs. Multi-modal stuff is in the future, but its on the Taxo and Cyborg roadmap, and according to them achievable within the 1 year term.

For AuroraTec, the inability of the company’s technology to automatically translate web-based content into WAP content compromised the profitability of each client relationship by requiring costly content customization. Of course, some support costs associated with the launch of a WAP-enabled service were to be expected, but AuroraTec promised “very rapid deployment – days not months.”

AuroraTec

- What makes us unique

- No changes to web site are required

- No persistent data stored in our servers

- Single architecture across multiple devices

- Very rapid deployment – days not months

- Web site can change substantially without affecting mobile access

AuroraTec initially targeted small, “emerging” internet companies, but as the reality of the post-bubble economy sank in, the firm abandoned the “small fry” clients and focused exclusively on larger, more established firms. Once a client website was set up for “automatic translation,” AuroraTec was eager to maximize revenue per month per client.

From: Jennifer Corby

Sent: Friday, June 16, 2000 5:39 PM

To: Jacob Wong; Lorraine Saunders; John O’Neill; Sebastian Dobson;

Luke Golden; Philip Martins

Subject: YOUR HELP REQUESTED with Marketing & Biz Dev Blast #8

Draft - please fill in the xxxxs like so and shoot me back any corrections/errors/ommissions so I can send this out sometime Monday.

Don't want anyone's nose to be out of joint and the best way to ensure this is to make sure you guys each have an opportunity to add your two cents.

Jacob Chan- item #2.

Lorraine - item #3.

John - item #4.

Sebastian - item #5, #6, #7

Luke - item #8, #9

Philip Martins - #11

The 8th in a series. To catch up on your marketing & biz dev. blasts go to \\Coffee\home\Marketing\ and look for a folder entitled "Marketing Blasts". This one should take you <5 minutes to read. And as incentive to read what's here - there's an opportunity for you to earn $6K.

Here's the stuff that's going on in marketing as we continue to build momentum. The summer's typically a slow period - but not for us!

1. CONTENT DISTRIBUTION DEALS. At PC Expo (June 27-29th) we'll be announcing content distribution deals with Allsite, Morningsun, ViewUSA and as many other players as we can line up in the next 2 weeks. Kudos to Lori Hume, VP of Enterprise Sales for pulling together these deals for us in response to feedback from the sales team. The goal of these deals is to provide our enterprise customers with bonus distribution, as needed to pull through revenue deals through the Enterprise Sales Group (Rick O’Connor). We'll keep you posted as we finalize the deals but the goal is to announce that we can reach ~500K wireless users through these partnerships.

2. SOLUTIONS FOCUS BOTH IN BUSINESS DEVELOPMENT AND MARKETING.

We've starting to realize that the best place to leverage partners

is 1) to open doors for us with Enterprise customers that might be

hard for us to crack on our own; 2) to complete our solution set

through partnering with other companies that have technologies

that are complimentary to ours; and 3) to snuggle up to the device

manufacturers to ensure that we keep abreast of their plans,

maximize comarketing opps, and are ready to mobilize

content/applications for each new device as it debuts. So we've

added some new faces to address these substantial opportunities.

In terms of leveraging our partners, each major partner has a

Global Account Manager who is responsible for understanding that

partner in full and how best to leverage the relationship into

awareness and sales on behalf of AuroraTec. Daniel Scott serves as

Director, Global Account Manager for our HP relationship; Keelan

xxx serves as Manager, Global Account Manager for Sun. The GAMs

report to Hesther Club, Sr. Director of Alliances. In terms of

completing our solution set, here there are three new people you

should know about:

Steven Eagleton - Director of Business Development - Enterprise

solutions

Pete Nguyen - Director of Business Development - Enterprise

solutions

Tony Leung - Director of Business Development - Information

Appliances

Steven, Pete, and Tony report to Jacob Wong, VP of Business

Development for the Enterprise, who in turn reports to me as Chief

Marketing Officer.

The first fruits of this effort will with a planned July 24th launch designed to showcase how we handle security on the wireless web. We'll be packaging several high level deals together in the security space to maximize our visibility here. This exciting effort is being led by Alex Tran and will be the first step towards us getting into deals that take us behind the firewall.

3. PR REVIEW PROGRAM. Since the launch on April 5, we've been fielding a ton of calls from the press and analysts about how they can try our service. Easier said than done, right - since it involves going to our different customer and downloading a PQA or locating the wireless URL. To solve this problem, PR is initiating a review program which will encourage reviewers to compare our wireless applications with the wimpy, sub-standard, impossible to use applications produced by the competition. The idea is to launch this mid July by mailing the reviewers a Palm VII and possibly a Smart Phone as well as a review guide so they can see the difference for themselves. The focus here is on the business press that covers the end user experience as well as analysts - but the core intellectual property we develop here - comparing and contrasting multiple applications within a given category - will be something we will look to leverage later - possibly in a challenge format. (Anyone remember the old Pepsi versus Coke Challenge?). As you can imagine this will be an enormous effort, one that Lorraine will head up.

4. EWEEK REVIEW. Whew! Glad that's over. What a great effort though. We flew out an entire team - including Lorraine, Evan, Luke, John, Pawan, and XXX to wonderful Wisconsin to mobilize a site on the fly in front of 18 highly critical IT professionals who acted as independent reviewers. Also in the review were GoForth, Olympos, WebWisom, and ourselves. Thanks to a great team effort led by John O’Neill in Technical Marketing and Pawan G. in Application Engineering we have high expectations that we'll get very positive ratings in this competitive shoot out. Look for the printed article during the week of July 21.

5. SALES MEETING. Yes, indeed, we will have a 2nd sales meeting in July. Right now its planned as a two-day event on Tuesday July 11 and Wednesday July 12. The focus here will be on learning best practices from each other, ensuring everyone can demo the product with confidence, and rolling out new tools designed to help accelerate the sales process and make our sales people even more productive. If you are new to the company and want to attend the training portion of these sessions, please contact Julie Jackson who can get you all the information. Exciting new tools we hope to have available at that time include white papers, additional presentation tools, and even drive time audio tapes so that folks can "get smart" about the nuances of our technology while they're on the go. (Now that's a concept!).

6. FIRST WEB-BASED SEMINAR. Our first web-based seminar is planned for Thursday, June 22nd at 10 am PST. Currently, we have about ~40 prospects who have registered to attend. We used email to drive people to the seminar, off of a targeted list of prospects. The title of the seminar is "How to kick start your wireless web strategy" and the goal is to assist sales and business development by taking prospects who are vaguely aware of AuroraTec and somewhat interested in the wireless web to the next step in the purchase process: active consideration of an AuroraTec solution. If you want to get a preview of this seminar - just see Julie Jackson - Brand Marketing Manager.

7. ELECTRONIC MARKETING. The corporate website is being revised even as we speak. The goal of the revision is to support our new, higher end positioning, and to provide us with the architecture we need as we move up to bigger accounts and into enterprise selling which tends to be supported with tons of white papers and the like. The new website is expected to debut on < date >. Also on or about < date >, we'll ship our first edition of AuroraTec Unplugged - which is what we are calling our first outbound emailing sent to customers, prospects, and friends of the business. AuroraTec Unplugged will go out every 6 weeks or so. Electronic marketing is currently negotiating to include 3rd party content (news & analysis specific to the wireless space) in the newsletter and to be able to pump that info through to the customers when they log in to see reports. Finally, electronic marketing has arranged to have our customer's content listed at the following sites through our partner "HubbaNet":

< List sites >

Keywords and meta tags have been inserted in our website to maximize our presence in the various listings. Each month about xxx people go to our site where they spend about xx minutes on average - an amazing thing, all things considered. In my experience, you are lucky to get 2-3 minutes of quality time with a prospect ... so 10 minutes is truly awesome. Something we will continue to monitor as our site morphs and changes.

8. ANALYST RELATIONS. We are well established with all the major analysts now with the possible exception of Mega and Patriot, having just held extensive briefings with Harvester, DCI, and the Ginger Folsom Group. Analysts are starting to talk about AuroraTec as the leading vendor in a market space that is increasingly crowded and confused. To cut through the confusion, there's an internal effort within marketing to clarify our positioning and move "up market". PR under the leadership of Lorraine Saunders is taking the lead on revising our corporate backgrounder to make what we do even more clear and to crystallize that positioning in a new boilerplate. And Strategic Marketing - under the leadership of Luke Golden - is working hard to create white papers that underline our competitive advantage.

9. PRICING. Continues to be a moving target. Our business is surprisingly complicated which makes pricing a challenge. A lot of people have worked hard to put together detailed pricing schedules and policies including myself, Luke, Jane P., Rick O’Connor, Emily, and Amit. I'm happy to tell you that we will shortly have two price schedules for our ASP service - one a premium service designed for enterprise customers and one a basic service designed for emerging companies such as internet start ups. Last quarter, the average revenue per customer (ARPC) we signed ended up paying us about $2.5K per month. In Q2, the goal is to end the quarter with ARPC of ~ $4.0K. We'll continue to push hard on moving ARPC up each quarter - by combination our new pricing with a new targeting strategy. While in Q1 we targeted emerging companies exclusively, this quarter we decided to let the small fry go entirely and focus our attention on medium- and large-businesses with a mix between the Enterprise segment and Emerging companies.

10. Q3 DEMAND CREATION PLANS. We've got a lot of things cooking for Q3 and we plan on sharing these plans with you right after July 4th when our plans are tad more "baked." Until then, if you've got questions or just want to check in on what we're doing - feel free to drop into the marketing staff meeting held each Monday at 10:30 in Wonder. But since schedules change - check with Paul Roberts first. For example, this Monday's meeting is happening Tuesday afternoon. But heh - that's life at a start up.

11. PRODUCT MANAGEMENT. The search continues for a capable Sr.

Director or VP of Product Management - someone with at least 6

years of enterprise software experience. If you know of someone

great, Marketing will double the bounty we normally pay on an

employee referral from $3K to $6K. Of course, you can't be a VP to

qualify, can't be the hiring manager, and we must end up hiring

the person you refer. That said, it's a great opportunity to pick

up some extra cash and help the company at the same time.

Meanwhile, we continue to work in a team format like so:

Luke Golden - Acting Product Manager - Portal

Sebastian Dobson - Acting Product Manager - Voice + Enterprise

solutions (e.g. Security)

John O’Neill - Acting Product Manager - Data + Emerging business

solutions (e.g. wireless advertising, affiliate programs)

Jennifer Corby - Licensing initiative

Luke, Sebastian, and John are committed to working as a team to

get engineering the info they need for the next release of the ERT

and ECS as well as to assist Amit and the rest of the engineering

team leaders in putting together an actionable Product Roadmap.

Jennifer Corby

Chief Marketing Officer

AuroraTec, Inc.

AuroraTec sought to make companies "ready for the Wireless Web," but as hard as it is to fathom from the perspective of the 5G world of the early 2020s, the wireless web was a "tomorrow" problem, and many of AuroraTec's clients had to make payroll that day. For an internet content company trying to weather the storm of the bursting of the Dot Com Bubble in late 2000, standing up a wireless website was a luxury, not a necessity. As a result, companies like AuroraTec - that provided services to these content providers - were squeezed. As was AuroraTec.

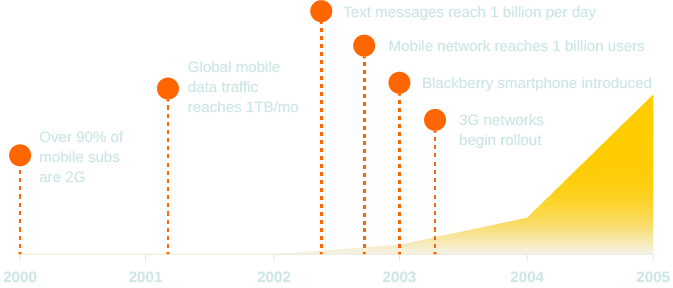

“Swimming with sharks”: Partnering with major wireless carriers

AuroraTec's dependency upon the major wireless providers generated different challenges. The carriers needed to balance a classic trade-off. On the one hand, wireless was their future. The transition to all-digital (2G) networks meant that voice and data could now share the same transmission channel. Demand for and use of wireless bandwidth rose dramatically – 100,000x (!) from 2000-2005 alone. However, in 2000 and 2001, the typical carrier was struggling to modernize their network. A mobile service provider needed to be able to demonstrate that the wireless web worked, that web content could be accessed via its digital pipes, but from a network use and stability perspective, voice was still the predominant service they provided.

Mobile Data Traffic, 2000-2005: Almost 100,000-fold growth

Source: "2000-2005, call me" graphic from https://blogs.cisco.com/sp/mobile-vni-major-mobile-milestones-the-last-15-years-and-the-next-five used with permission of Cisco.

Strategic opportunity or mirage?

AuroraTec offered a crosswalk, a temporary pathway that allowed a wireless provider to expand its wireless services without having to build out its internal capabilities ahead of demand. AuroraTec bought time for the wireless providers, but if AuroraTec's "transformation" service was too good, wireless usage may have grown too quickly, putting pressure on wireless networks that were already struggling to keep up with digitization and increasing subscriber growth and usage.

Maybe the very wireless companies that were experimenting with outsourced “mobilization" didn’t want the service to work too well, lest it destabilize their other established, taken-for-granted, revenue-generating operations?

Pushing on a strategic string?

Urgency was a critical feature of many start-ups’ business pitches. Internet consulting firms – once called i-builders because they were hired to build Internet sites for new and existing companies – would promote “internet time” as a critical concern: move quickly, they would say, or you will lose the race to “Get Big Fast.”

You have more money than time!

Revenge of strategy: Whose clock was really ticking?

For AuroraTec – as for many other internet start-ups seeking to partner with large, established companies like the mobile wireless providers – the urgency to execute was a construct. Startups like AuroraTec needed the mobile wireless providers to believe in the need for urgent strategic action so that they could land new clients and expand their fledgling businesses. But in practice, especially after the peak of the bubble in March 2000, it was the startups that were running out of time. The large telecom companies whom AuroraTec sought to serve had other priorities and could afford to move more deliberately into the wireless web.